Nvidia creates winning ETFs | Fox Business

Cambria Investment Management founder and CIO Meb Faber weighs in on how investors can position their portfolios and discusses the new tax-conscious ETF ‘Making Money.’

The three best exchange-traded funds of 2024 have one thing in common: each is linked to AI super-stock Nvidia.

The Rex 2X Long NVIDIA Daily Target ETF and the GraniteShares 2x Long NVDA Daily ETF advanced more than 400% each, while the Direxion Daily NVDA Bull 2X Shares rose more than 350%, according to VettaFi.

The three best-performing ETFs of 2024 are linked to Nvidia (VettaFi)

“NVDX, NVDL, and NVDU are 2x long bets based on Nvidia that are often used to capture short-term returns. Investors can double their gains (or losses) on Nvidia’s daily returns during big news events like earnings,” Roxana Islam, VettaFi’s. head of sector and industry research told FOX Business.

| A ticker | Security | Finally | Change | change % |

|---|---|---|---|---|

| NVDX | OPPORTUNITIES ETF TR T REX 2X LONG NVIDIA DAILY | 19.81 | +0.24 |

+1.24% |

| NVDL | GRANITESHARES ETF TRUST 2X LONG NVDA DAILY ETF | 81.68 | +1.10 |

+1.37% |

| NVDU | DIREXION DAILY NVDA BULL 2X Stocks | 131.63 | +1.59 |

+1.22% |

With Nvidia shares up more than 200% by 2024 the numbers were high with strong third quarter results. Revenue rose 94% to a record $35.1 billion from the same period last year, while earnings jumped 111% to $0.78 per share. Both exceeded Wall Street estimates.

Ed Egilinsky, managing director at Direxion, told FOX Business before the results that his ETFs are for smart investors, big and small, like NVDU.

| A ticker | Security | Finally | Change | change % |

|---|---|---|---|---|

| NVDA | The company NVIDIA CORP. | 147.08 | +1.19 |

+0.82% |

“It provides twice the return of Nvidia’s common stock in one day,” he said. “Averaging can work for you if something is going your way, unintentionally. But these vehicles are built as short-term trading vehicles for active traders and should be monitored daily. You can’t just look at it and say ‘forget it,’ even if Nvidia does very well but most stocks don’t go up consistently and reach greatness.” of Nvidia.

BITCOIN WHALE ETF HITS NEW PAPERS

A semiconductor chip mounted on a circuit board. (Reuters/Florence Lo/Illustration/Reuters)

Shares of Nvidia fell before recovering by midday on Thursday. For those investors who wanted to hold the ground, some ETFs fit that strategy.

“We also have a non-leverage inverse short. So that would be the opposite of what Nvidia does on a one-day basis. So if Nvidia goes down 5% tomorrow, let’s say we have a car that can do it. 5%, and that’s NVDD ,” added Egilinsky.

| A ticker | Security | Finally | Change | change % |

|---|---|---|---|---|

| SOXL | DIREXION SHARES ETF TRUST DAILY SEMICONDUCTOR BULL 3X | 28.64 | +1.48 |

+5.45% |

| SOXS | DIREXION SHARES ETF TRUST DIREXION DAILY SEMICONDUCTO | 23.12 | -1.51 |

-6.13% |

With a market cap north of 3.5 trillion, Nvidia’s flexibility across the market and semiconductor sector is significant. Investors looking to capture the upside or downside of a basket of semiconductor stocks can play Direxion’s Daily Semiconductor Bull and Bear 3X Shares SOXL or SOXS, Egilinsky noted.

The company forecast fourth-quarter revenue of $37.5 billion plus or minus 2%.

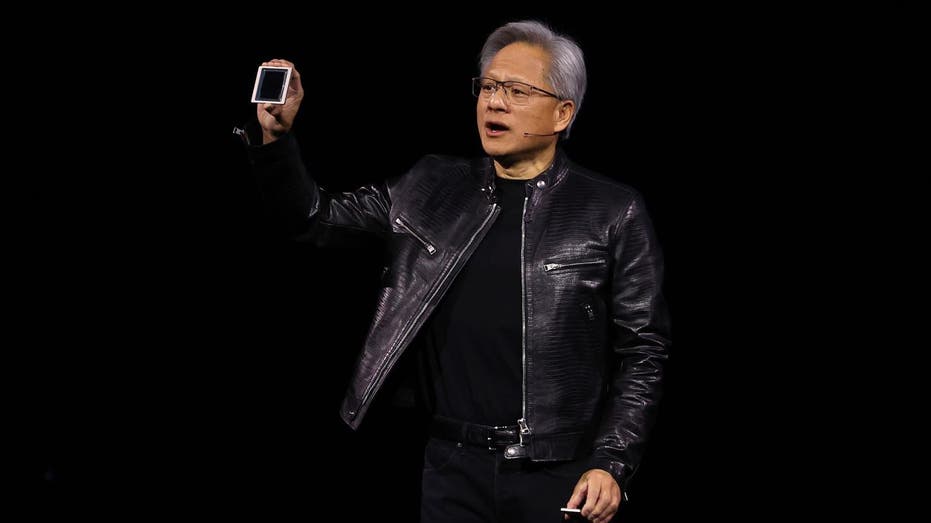

“The age of AI is in full swing, driving the global shift to NVIDIA computing,” said Jensen Huang, co-founder and CEO of NVIDIA noting the demand for both Blackwell and Hopper chips.

Nvidia CEO Jensen Huang delivered a keynote speech during the Nvidia GTC Artificial Intelligence Conference at the SAP Center in San Jose, California, on March 18. (Justin Sullivan/Getty Images/Getty Images)

Nvidia Chief Financial Officer Colette Kress told investors during last quarter’s earnings call about the expectations for these faster chips.

“Blackwell’s production ramp is scheduled to begin in the fourth quarter and continue through fiscal year ’26. In Q4, we expect to earn several billion dollars in Blackwell profits,” Kress said.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Nvidia CEO Jensen Huang will sit down with FOX Business’ Liz Claman on “The Claman Countdown” at 3 pm ET on Thursday.

*This story has been updated to include Nvidia’s results.

Source link